We asked contract manufacturers to let us in on the things they don’t tell their customers. Here’s what they told us.

1. They really don’t want to give you a fixed price.

Jerry Melsky, VP of Engineering at CardioFocus, says CMO partner Minnetronix tried to work within a fixed price on one product. “I think we both learned a lot from that experience. I’m not sure they’d be willing to do that again, but it was an interesting experiment.” That’s because in medtech, the goalposts always move. “There really isn’t any such thing as a fixed price contract, because there really isn’t any such thing as a fixed deliverable specification,” Melsky explains.

2. It will cost more than you think.

“In a startup, for example, when a mistake happens or a schedule slips or something goes wrong, the expectation is people double down or triple down on their efforts to fix it. With a contract manufacturer, they’ll do that work, but it also translates into them doubling down and tripling down on their billing. It can come as a shock to the people who are doing development work,” Melsky says.

3. The big guys get the price breaks.

”If you’re one of the big beasts in the industry, if you’re Johnson & Johnson or Medtronic, your suppliers will be a little bit more willing to choke down some overruns for the sake of continued business,” Melsky tells us. With smaller firms, CMOs have to factor in the risk that the client might not be around in a few years. “For those companies, CMOs have to get paid for the effort that they put in.”

4. Their 1st price estimate “comes out of our a$$”

“The initial price we give comes right out of our a$$” because of the aforementioned moving goalposts, says one business development executive at a well-known CMO, who understandably asked to remain anonymous. “Probably the biggest problem is, unless you’re in a business where everything you do looks the same, it’s really hard to get data for how long and how much it’s going to take something to do,” Melsky explains. “Somebody says, ‘Oh, yeah, we’ll do this job for you, and the cost is’ whatever. The cost is $75,000 or it’s $3 million, and the timing is X. Those numbers and those dates are never the reality.”

5. The margins are thinner than you think.

“OEMs underestimate how thin the margins have to get in certain areas, the level of effort it takes to bring a product into a quality system,” according to the CEO of another prominent CMO, who agreed to speak candidly in return for anonymity. He also noted that being in candid and frequent communication with your CMO is essential. “Customers often don’t realize that contract manufacturers don’t know everything customers know about their product,” he says.

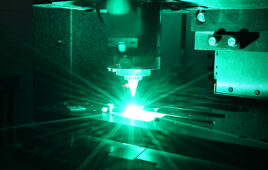

6. They don’t have – or need – the latest and greatest equipment.

“We aren’t going to simply install the newest technology because it’s cool. We use it when it makes sense for the business,” Tegra Medical Vice President Mike Treleaven tells us. “Everyone has gaps in technology. Companies have to consider 95% of their business and purchase capital equipment based on those needs. Everyone has gaps in technology. That said, if there is a partner involved who needs the technology and there is a potential to strengthen our relationship and add to our capabilities, then we will make an investment.”

7. The given wisdom on off-shoring is wrong.

Hans Lang, CEO of Wisconsin Tool & Mold, rejects the given wisdom that, if an OEM is going to be successful, it has to consider off-shoring. “Companies should take care of their people, but most CEOs care about stockholders more,” Lang says. “We want to work with people who appreciate the American market. We have a responsibility to our people first, to offer a decent and affordable life; we want to produce quality.”