The supply chain for medical devices, particularly implantables, is very complex. Although a distributor often manages the inventory, manufacturers hold it in title. In addition, there are multiple parties involved at any given stage, and inventory changes hands quickly. The result is a high-value inventory battling competing interests, and high risks to the manufacturer, including adherence to FDA regulations.

The supply chain for medical devices, particularly implantables, is very complex. Although a distributor often manages the inventory, manufacturers hold it in title. In addition, there are multiple parties involved at any given stage, and inventory changes hands quickly. The result is a high-value inventory battling competing interests, and high risks to the manufacturer, including adherence to FDA regulations.

That’s why it is hard to believe that many medtech companies still rely on antiquated logistics and inventory tracking. Some have decentralized systems that rely on a combination of ERP and spreadsheets. Others use manual entry systems into the ERP, shipping to either sales reps or hospitals. Both introduce risk to the process, by requiring recipients to confirm orders, or find missing information.

Seiyonne Suriyakumar, business development representative for Mobitor Corp. describes two orthopedic clients that were experiencing challenges:

Orthopedic Device Company 1

A small company that began experiencing rapid growth. As they grew, they struggled to continue using manual methods (calls, emails, faxes, whiteboards) to manage inventory. The manual nature of those requests meant the customer service team would often need to call reps back to confirm orders that they couldn’t understand or that were missing information. Orders were then manually entered into their ERP system, and if necessary, inventory was then shipped out to either the rep or hospital. Once a case finished, the rep would again send over consumption information, triggering another cycle of manual data entry, clarifications and questions. They had briefly looked at some cloud-based systems, but were dissuaded because they were so much more than the company required and weren’t flexible enough to fit (and were also far too expensive).

Orthopedic Device Company 2

An established operation that relied on a combination of their ERP and spreadsheets to track inventory. Without a centralized field inventory system they had sub-par inventory planning, gaps in service, duplicative data entry and numerous discrepancies. The company made the decision to move away from that system in order to cut costs. It needed to ensure employees had the right systems in place to be sustainable, and positioned for growth. The companies looked at several systems in-depth, but outdated UX/UI, a challenging integration process, and the lack of some key features kept them from partnering with anyone.

Does any of this sound familiar? If it does, there is an outcropping of firms that are creating a better system to help medical device companies manage this complex process.

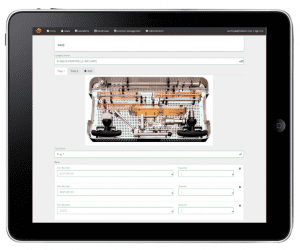

One such company is the aforementioned Mobitor, which has created the TurnsLift system. TurnsLift is a cloud-based platform designed to give both reps and operations teams full visibility into field inventory operations. Suriyakumar says TurnsLift is made up of several software modules. Users access them either through a web interface or via the mobile applications.

“Apple calls this approach a constellation, because each module can stand independently, but when required, they deep-link with each other to create a seamless experience,” he says.

What’s interesting about the modules is that they allow user to perform specific functions (e.g., case scheduling, inventory management, consumption, billing, etc.) in a standardized way.

“We built TurnsLift to provide a streamlined UX to encourage adoption and to specifically to address concerns that software was too complex and wasn’t configurable enough,” says Suriyakumar.

The company included features like a workflow configuration engine, so device firms can change how statuses and notifications are triggered. In addition, TurnsLift includes SDK (software development kit) so that companies can have their own IT teams build proprietary modules on top of the technology.

Further, the product is designed for products used in the field.

“We built it mobile-first to ensure that the UX on a smartphone/tablet looked like it was meant for a smartphone/tablet, not like a shrunken-down version of a desktop application,” he says.

TurnsLift was purpose-built to address the needs of the medical technology supply chain. “It is meant to handle unique situations like a mix of consignment and loaner inventory, expired parts in a kit, inventory overloads (multiple destinations for the same inventory) in the field, and robust integrations to ERPs like SAP or CRMs like Salesforce,” says Suriyakumar. It is meant to be a useful tool for both reps and distributors, while providing increased visibility and uniformity in inventory management for manufacturers.

As for the two orthopedic companies TurnsLift has been working with, Suriyakumar says they’re confidant that the system will help them master their inventories as they grow. He’s planning a demonstration with one firm later this month.

“Because the stakes are so high in medical devices, companies need a logistics tool that is specific to their industry and workflows, not one that is generic and rebranded as ‘medical,’” says Suriyakumar.

![A photo of the Medtronic GI Genius ColonPro polyp detection system flagging a potential sign of colon cancer during a colonoscopy. [Photo courtesy of Medtronic]](https://www.medicaldesignandoutsourcing.com/wp-content/uploads/2024/04/Medtronic-GI-Genius-doctors-268x170.jpg)