Wearables for health fall into a wide range of technologies, functions, use cases and over-arching regulatory frameworks that developers and prospective entrants have to understand in order to effectively compete. Using an underlying taxonomy for human health, we establish a health-focused wearables taxonomy around three major categories—applications, use cases, and form factors—the three areas critical to understanding the current state of this emerging market. We examined the product specs of 224 wearable devices from 209 developers, limiting the analysis to devices that are either currently on the market or available for pre-order/crowdsource funding. Looking inside the quality and quantity of devices in the ecosystem presents a snapshot weighted toward what is faster to commercialize and drive adoption for today, but with plenty of space to target for longer term and far more valuable applications and markets.

We examined the product specs of 224 wearable devices from 209 developers, limiting the analysis to devices that are either currently on the market or available for pre-order/crowdsource funding.

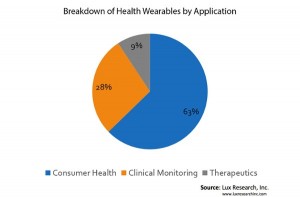

The most notable segmentation looks at applications, comparing wearables activity in consumer health, clinical monitoring, and therapeutics devices. Consumer health applications relying on proven but feature-limited sensors currently receive the most attention, with nearly 2/3 of all devices targeting consumer health applications (63%). The reasons for this are both technical and structural. Many available devices do not conform to more stringent clinical accuracy requirements, leaving developers with limited options in more lucrative—but harder to develop—clinical markets. In addition, a large number of companies shy away from having to deal with regulators, choosing to stay in the unregulated consumer health markets.

Within the consumer space, more than half focus on tracking and training guidance needs of physically active users, a space where the name brands are well known and struggling to maintain any meaningful level of differentiation. Large, established players with specialized products such as Fitbit, Jawbone and Garmin are now facing increasing competition from multipurpose smartwatches from Samsung, Apple and Pebble. That said, a growing number of applications focus on monitoring everyday activities that have a direct impact on users’ well-being, such as nutrition and sleep quality. These less crowded spaces represent key pieces in the fully quantified self that will be needed for optimal health and wellness.

Despite the understandable focus on the consumer space, developers must position for the much larger future of clinical monitoring devices that will overtake the consumer space in market size within the coming decade. More sophisticated devices will enable this growth, and the smart consumer device manufacturers will have this goal in mind. Look for many athletic developers to move toward clinical applications as their product quality improves. Most athletic devices do not have the accuracy or reliability for clinical applications today, but improving technology, including sensors, will push them toward more lucrative clinical applications. One key class, in-vitro diagnostics technologies, are barely making a dent in the wearables market today, but are going to be the largest portion of the clinical mHealth ecosystem of the future. With the advances in sensors, microfluidics, and energy storage, expect many of the diagnostic tests to be implemented in the wearable form factors, allowing patients to be diagnosed outside of traditional care settings.

Lux Research

www.luxresearchinc.com