The breakneck pace of consolidation continued in 2017, significantly reducing the pool of Big 100 companies, as cash-laden companies scooped up smaller firms.

The medical device industry may not be keeping pace with initial public offerings in biotech, but medtech is holding its own when comes to mergers and acquisitions, according to industry watchers.

The medical device industry may not be keeping pace with initial public offerings in biotech, but medtech is holding its own when comes to mergers and acquisitions, according to industry watchers.

By mid-August, Boston Scientific alone had bought seven companies and 11 venture-backed deals had gone down; Johnson & Johnson bought French robot-assisted surgery company Orthotaxy in February.

“The biotech industry has been in a resurgence over the last few years with many high-value IPOs. The medical device industry hasn’t garnered the same IPO headlines, but there have been a number of megamergers between the medtech giants and many meaningful acquisitions of early-stage companies by the big players,” patent attorney David Dykeman, a shareholder with the Greenberg Traurig law firm in Boston, told Medical Design & Outsourcing.

(Sign up for our e-newsletter, and download an Excel version of our full Big 100 list.)

(And you can also pick up a free hard copy of the Big 100 issue at DeviceTalks Boston on Oct. 8–10!)

The medtech megamergers of the past few years have created huge medtech companies that are looking for early-stage acquisitions providing innovative solutions that treat a large unmet medical need in a cost-effective and reimbursable manner, Dykeman said. These smaller companies can bring new disruptive technologies to market quickly, and if the innovative technologies have been de-risked via regulatory strategy, intellectual property and patient adoption, the big players are often willing to pay a premium for them, he added.

They can certainly afford it, according to Matt Arens, CEO and senior portfolio manager of First Light Asset Management, a healthcare investment firm based in Edina, Minn.

“The large buyers have unprecedented levels of cash,” Arens said. “We’re still in a low-interest-rate environment, so that cash is largely a nonperforming asset. Finding durable growth assets, we think, is critically important to the large companies’ future growth.”

Companies seeking pre-market approvals or de novo clearances from the FDA continue to attract more interest from suitors than 510(k) clearance holders, and they make quicker exits, according to Jonathan Norris, managing director of the healthcare investment practice at Silicon Valley Bank in Santa Clara, Calif. PMA and de novo seekers also tend to represent bigger market opportunities to acquirers and may already hold the CE Mark in Europe – with data from that market to boot.

Products that hold a 510(k) clearance “are typically a nice piece to add to your grouping of products,” but don’t generate the excitement of a game-changing device in a high-need area of healthcare, Norris told us. Prospective acquirers want the companies that make these devices to prove their salability, build up their sales force, win reimbursement and ramp up revenue before being considered for acquisition.

“They have to prove that the dogs are eating the dog food,” Norris explained. “Acquirers out there are so [earnings-per-share]-focused, these public companies, that they don’t want to acquire companies that they have to put a lot of money into unless they’re game-changers.”

“The bigger guys want growth. They want something that’s growing faster than their core business,” agreed Mike Matson, senior equity research analyst at Needham & Co. in Boston. “If they’re growing at 5%, they probably want something to grow at 10%-plus.”

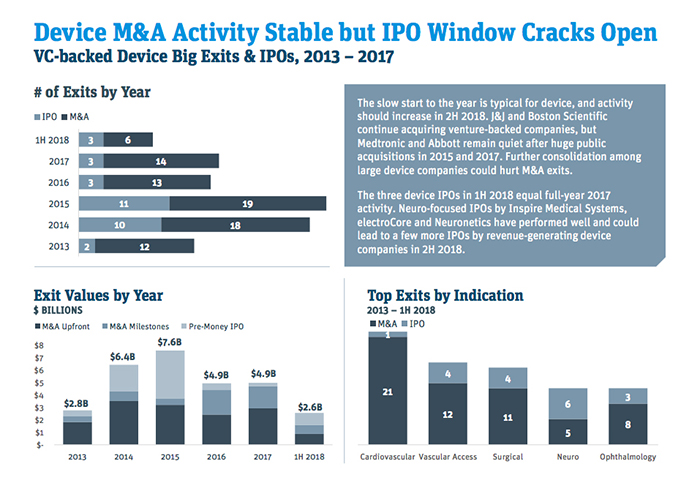

Venture-backed M&A has been roaring ahead, with five deals announced from July to mid-August and 11 year-to-date, including four undisclosed agreements, according to Norris. Deals that have been made public include bids for TVA Medical by Becton Dickinson; ReCor Medical by Otsuka Holdings; and Claret Medical, Cryterion Medical and Veniti, all three by Boston Scientific.

“It seems like it’s second half of the year loaded for venture-backed M&A,” Norris said. “We’re already at 11 and that bodes well for them hitting the mid-teens mark, which would make it a very solid year and put them in the middle of where we’ve seen activity over the last five years.”

Larger players are willing to place an earlier bet on early-stage companies with very promising technologies, but if the targets are willing to wait longer for an acquisition, they can fetch a much higher price. Among public companies, the wait-for-it trend has become a drag on medtech M&A, according to Matson.

He sees some smaller public companies’ sky-high valuations giving would-be acquirers pause and expects the number of M&A deals in 2018 and their dollar volume to decline compared with 2017 because of it.

Counting veterinary devices, two deals of more than $1 billion have been announced for 2018, Zoetis’ pending acquisition of Abaxis for $1.7B and ICU Medical’s $2.7 billion bid for Smiths Medical. As of June 30, there were 102 deals totaling $9.5 billion; at that pace, Matson estimated a total of 207 deals worth $19.3 billion in 2018, compared with 242 deals worth a collective $45.5 billion last year – which would make this year the one with the lowest number of deals since 2002 and the lowest dollar volume of deals since 2011.

Public companies’ multiples influence private companies’ valuations, even if they’re not exactly in sync, Matson has found. “That may become a more fertile ground for M&A, because they’re not as expensive and there are a lot of private things out there that can get acquired,” he said.

Medtech market-watchers are wondering when Medtronic and Abbott, quiet since their major acquisitions in 2015 and 2017, will jump back in the game.

“When one of the big acquirers is quiet, that gives them more of an opportunity to look for what they want to add to their portfolio and maybe at a price that fits with what they see as value at this point,” Norris said. “If you have less potential acquirers, it’s harder for companies to get bids to bump up the price.”