Gerardo de la Concha asked a provocative question in his keynote address at the Westec conference Sept. 15-17, 2015 in Los Angeles: “Is unconventional product development worthwhile?”

Gerardo de la Concha asked a provocative question in his keynote address at the Westec conference Sept. 15-17, 2015 in Los Angeles: “Is unconventional product development worthwhile?”

It’s a question medical manufacturers have to ask themselves every day. Innovating beyond iterative product development can cost significant amounts of time and money. And it’s risky, because those resources might not be recouped. But a successful project could lead to a big payoff, and in some cases could be the key to a company’s ability to survive in the medical space.

It’s unlikely that Medtronic will fold based on a single product failure, but many of its acquired technology companies face the same challenges as a small medical device company. These individual facilities have to prove their worth in the marketplace and in Medtronic’s corporate offices.

De la Concha, the VP of Operations for Medtronic Mexico, demonstrated this idea with a story he at the Westec event involving a plant in Empalme, Mexico. If you haven’t heard of Empalme, you’re not alone – it’s a sleepy beach town in the state of Sonora with a growing aerospace industry and a robust metallurgy school at the University of Sonora. The Empalme facility is also the star of this story, but to understand it, it helps to review the dynamics at play.

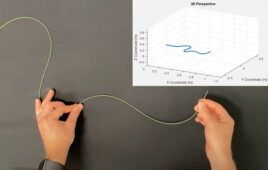

In 1998, de la Concha told attendees, “I was employee number 1 of Medtronic Mexico, which was the Tijuana plant.” He was tasked with bringing Medtronic to Mexico with (among others) an endovascular device used to prevent abdominal aortic aneurysm. The device is a mesh tube with nitinol rings. The tube is compressed to the size of a catheter, but upon deployment, resembles a garden hose. Its simple look belies its expense and incredible complexity. The NiTi rings are notoriously difficult to manufacture because of nitinol’s instability. Medtronic outsourced manufacture of the rings to a few suppliers at a cost of $35 apiece. Furthermore, the entire device is hand-sewn, making the manufacturing process very labor-intensive.

In 2004, Medtronic acquired the tech facility in Empalme. Its San Francisco Bay-area parent company had developed a NiTi U-clip that surgeons could use during heart valve replacement surgery. The clip, which was intended to replace hand-sewing by surgeons, had shown clinically superior results and was a unique product, according to de la Concha. But when Medtronic’s corporate office wanted him to shut down the plant and absorb it into the Tijuana facility, he objected.

“It was too different from what we did in Tijuana, and there was no cost benefit to moving it,” de la Concha said. The clip was a useful product that had seen decent success on the market and he did not want to get rid of it, so the Empalme facility and its 60 workers remained in stasis for several years, facing annual shutdown threats.

Then things started to change in the marketplace. Fewer doctors wanted to use the U-clip, because it turns out the hand-sewing is a signature skill for the surgeon. Medtronic was struggling to find ways to improve the endovascular device to maintain market share in a competitive landscape. At a certain point, the process couldn’t be trimmed any further and it came down to a question of cost-cutting on components. NiTi ring suppliers had patents on their design and production processes, and were not willing to bend on the price per ring. Neither were the suppliers willing to let Medtronic into a facility to see the process of ring production.

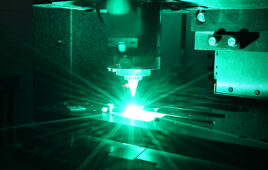

“Our suppliers were giving us no leverage. So we decided to work in secret to reverse-engineer the NiTi ring,” de la Concha said.

After hours, his team tried to find ways to recreate the peak-and-valley design of the ring. The skunkworks project was a difficult challenge: The device had to be robust enough to withstand compression and blood pressure for 20 years after implantation. After about 6 months, the team had some visual samples to show the corporate office. They were able to project that the team needed 2 years and a certain amount of funding to continue development. De la Concha was certain that his team could develop a ring produced for only $15 per unit, which would save the company approximately $20 million per year, convincing Medtronic to go ahead with the project.

After 18 months, the Empalme team was able to enter into IQ OQ PQ and characterizations. After another year and a half, the company had taken the work through the global regulatory process.

By fiscal 2010, Medtronic was producing the NiTi rings; in the first year it saved the company $20 million. Today, de la Concha said the Empalme facility is able to produce the rings at a cost of $7.50 each. In addition, the group at Empalme expanded to 700 employees and now has responsibility for the secondary sewing process in the endovascular stent – but it no longer manufacturers the ur-tech U-clips. De la Concha said the team is not done experimenting with design changes.

“We are looking for ways to bring the price down to $5 per unit, and eventually get rid of the NiTi component altogether to further reduce the price,” he said, noting that the Empalme team was extremely motivated to improve the process and prove their value to Medtronic. Because of their efforts, the facility is an esteemed and growing tech center.

“I knew where we had to go, but I didn’t know how to get there. It’s a credit to the team at Empalme that they found the path and were able to connect with the right experts to get there,” de la Concha said.

A lesson for suppliers

It’s a feel-good story with a darker lesson at play, particularly for companies that serve as suppliers to Medtronic. As de la Concha puts it, “We left a few bodies along the way.”

Medtronic dropped one of the ring suppliers and the remaining NiTi developer has had to scramble to meet the new price point. Supply companies should pay attention when Medtronic asks for better pricing. It’s a company dedicated to finding a better, faster and cheaper way. Firms that feel too secure behind their IP and do little to improve customer service stand to lose a powerful client.

so, suppliers, you have been warned. Next time Medtronic, now the largest Irish Company, comes in for a scrupulous audit, know the next body left along the way could be yours.

I worked for a West Coast manufacturer of Bio-Lab instrumentation; and we needed small sample cups for fraction collection purposes on a CE device. So we had a mold produced for Duck-billed lids; and worked with the lid OEM to come up with a ‘rubber’ compound that was both plyable, yet did not allow for evaportion through the material of small organic compounds (eg. MeOH).

After testing several dozen mixtures, we (or should I say the OEM) found the best compound.

When the system eventually died in the market place and could no longer support logical manufacturing of the caps (at such a low volume),the OEM lets us know by jacking up the price to suit the situation (for them). It then became clear we did NOT have an agreement as to sharing the precise composition of the optimized compound for the caps, so even if we took our molds to another vendor, we would need start the compound derivation all over again. Moral: Engineers sometimes need a class or two in business.