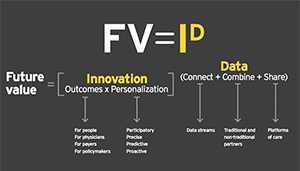

The new EY report even includes an equation to show how medtech and other life science companies will need to deliver value: “Future value (FV) is driven by innovation (I) that focuses on outcomes with a high degree of personalization and is fueled

by unlocking the power of data (D.” [Image courtesy of EY]

The report — Life Sciences 4.0: Securing value through data-driven platforms — quotes Johnson & Johnson CEO Alex Gorsky to indicate where things are going: “Technology will touch everything that we do, whether it’s the way we use data to better understand the genome … or as it applies to things like minimally invasive surgery, even the way we talk to consumer vis-à-vis social media.”

Technology isn’t the only factor driving the change. Aging populations in the developed world mean that both public and private payers are tackling budgetary constraints and longstanding inefficiencies in healthcare systems.

In the medical device industry, companies are having to decide whether they are products companies selling to health providers or services companies focused on patients as a customer, according to the report’s author, Pamela Spence, EY Global Life Sciences industry leader.

“I think companies need to decide what they want to be. … It’s hard to do both,” Spence said during an interview with Medical Design & Outsourcing.

“I’m absolutely convinced that unlocking the power of innovation with data is the key to the industry. And whoever can harness that will stand themselves in good stead,” Spence said.

The report lists three areas that life science companies, including medical device companies, will have to master: customer engagement, personalization and data literacy.

New companies at the gates

A breakthrough could happen sooner than expected, according to the EY report. Diverse organizations — including high tech giants — have joined forces over the past year to create new health services and products as they seek to redefine the way healthcare is delivered:

- Major U.S. pharmacy chain CVS Health in December 2017 said it plans to acquire Aetna, one of the US’s largest commercial insurers, for $69 billion;

- Five U.S. health systems, led by Intermountain Healthcare, plan to create their own not-for-profit generics drug business;

- Apple has a new feature allowing people to obtain, view and keep their medical records on their iPhones;

- Amazon, Berkshire Hathaway and JPMorgan Chase have a partnership to tackle rising health care costs for their U.S. employees.

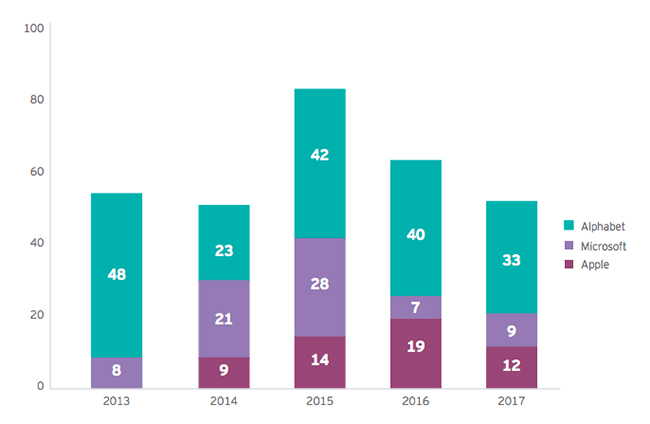

Also look no further than the hundreds of healthcare-related patents that high tech giants Alphabet (Google’s parent company), Apple and Microsoft have filed in recent years.

Technology giants have filed hundreds of healthcare-related patent applications in the U.S. [Graph courtesy of EY, based on EY analysis of U.S. Patent and Trademark Office data as of Jan. 31, 2018]

“The number patents being filed is not insignificant in recent years. You patent something when you’re excited about it,” Spence said.

Forming partnerships to compete

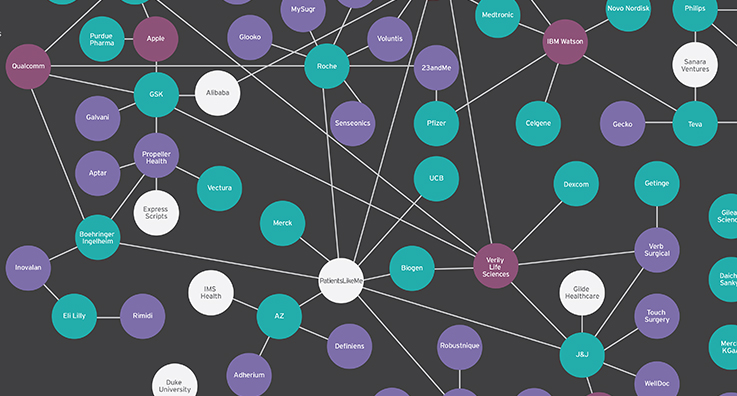

To better compete, life science companies, including in medtech, have been inking a slew of digitally focused partnerships with companies and organization outside the industry, including with the high tech giant. EY analyzed 150 of the deals struck since 2014. EY found 51%of the deals involved new products or services providing end-to-end solutions. Another 23% of the deals involved adding features such as real-time data capture or improved consumer engagement to an existing product and service, and the remaining 26% were for real-world data collection. The diabetes space — at 25 deals — had the largest share.

One of the major challenges going forward will be the cultural differences between the large, legacy life science companies — more cautious and mindful or regulations — and the technology companies, with their fast decisionmaker, according to Spence.

“Long gone are the days when any one organization has all the skills and competencies,” Spence said.

Here’s just a sampling of the type of relationships that life science companies are striking.