Yole Développement released a new report dedicated to MEMS devices and sensors for smartphones applications: MEMS & Sensors for Smartphones Report.

This report provides market data on MEMS & Sensors for mobile phones: key market metrics & dynamics including unit shipments, revenues and average selling price by type of MEMS & Sensors, market shares with detailed breakdown for each player.

This analysis also presents application focus on key sensors that are changing the mobile phone industry: new features, technical roadmap, insight about future technology trends & challenges.

Yole Développement also analyses the MEMS & Sensors value chain, infrastructures & players for the handset business (list of players for each device, key suppliers and emerging players, business models …)

MEMS & Sensors, a tremendous growth

Integration of MEMS components and sensors is not new to the mobile phone industry. For example, FBAR RF filters and silicon microphones have been integrated on mobile phones since 2002. More recently, MEMS accelerometers have been established as a “must-have” feature for many smartphones and feature-phones. And other types of sensors, like CMOS image sensors, have experienced a large success in the recent years.

But the mobile phone market is changing extremely quickly. It appears that in 2010 we are at a turning point in the history of MEMS & sensors for handsets: the market for MEMS & sensors will experience double digit growth, from $ 3.55B in 2009 to $ 7.91B in 2015.

Yole Développement has identified several factors explaining why MEMS & sensors will experience this tremendous growth over the next few years:

– Share of smartphones is rising faster than ever: 44% of the mobile phones will be smartphones in 2015. Success of smartphones is leading to an increasing amount of MEMS & sensors in mobile phones to provide new features/services to end-users, to reduce cost through more integration or to improve hardware performance

– GPS integration is not limited to high-end phones anymore. Nearly one phone in three will incorporate GPS in 2010. This is an additional driver to integrate motion sensors : when combined with compass, accelerometers or gyroscopes, this enables new services to be deployed

– The RF part of cell phones is currently changing very quickly, with more and more multi-band multi-mode mobile phones. The incoming deployment of new standards (LTE network in particular )has a direct impact on RF components and will open new doors for online services using an increasing amount of sensors

US$ 1.19B for the motion sensor market in 2015

One striking illustration on how quickly things can happen in the mobile phone industry is the recent release of iPhone 4, the first mobile phone to integrate a MEMS gyroscope, followed a few days later by the announcement of InvenSense IPO. The gyroscope business is now expected to boom very quickly: at Yole Développement, market analysts believe that the gyroscope market for mobile phones will be more than $ 80M in 2010 already. They believe strongly that the impact of gyroscopes on the user experience will be as high as the accelerometer case. Only 3 years ago the first accelerometers were integrated on mobile phones, at a price level similar to gyroscopes today. Now accelerometers are viewed as commodity products in some platforms and their penetration should be above one third of cell phones in 2010. “Total motion sensor market for mobile phone will reach $ 1.19B in 2015, with a 25.3% CAGR”, says Laurent Robin, MEMS Market Analyst at Yole Développement

Gyroscopes are not predicted to be the only “killer app” in handsets for the years to come. Many other significant changes are also expected:

– While the accelerometer and compass try to offer differentiating features, gyroscopes are now entering the mobile phone business, and efforts are also put on pressure sensors. Combo of motion sensors with an increasing processing part are now in development

– RF filters, variable capacitors and silicon MEMS oscillators should benefit from the changes occurring at the radio-front end level, from the increasing market for duplexers to the LTE impact on multi-mode phones.

– Silicon microphones are being accepted by the handset market. The cost benefit of ECM tends to decrease, and silicon microphones offer many other advantages. The emergence of dual-microphone solutions for ambient noise cancellation is going to push this business.

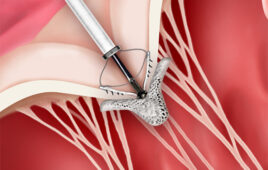

– Many innovative developments in the optical MEMS area are observed. Integrated picoprojectors could make the micromirror market take off, while new microdisplay concepts expect to widely decrease power consumption.

– CMOS image sensors are already a very big business. The battle is intense between the competitors to develop the next key features such as BSI, WLO, autofocus solutions or stabilization.

– Many other emerging sensors have been identified, with the potential to become new killer applications in 5 to 10 years: microspeakers, environmental sensors…

Such an attractive market brings with it intense competition between players. Yole Développement observes very quick changes in the supply chain since 2 years with the emergence of new players, the alliances between companies and regular fundraising / acquisitions, in particular when it comes to start-ups. IDMs such as ST Microelectronics have been established as business leaders, by offering reliable components, high level of customer support, an extensive product portfolio and huge price reduction. However few fabless companies have been successful and many innovative fabless start-ups are expected to impact the market within a few years.

SOURCE