Lifesciences investment group Abingworth Bioventures has closed its latest fund, Abingworth Bioventures VII (ABV VII) at $315 million. The fund — Abingworth’s 12th invested in companies in Europe and the U.S. — exceeded its target of $300 million. The firm has more than $1.2 billion under management.

Lifesciences investment group Abingworth Bioventures has closed its latest fund, Abingworth Bioventures VII (ABV VII) at $315 million. The fund — Abingworth’s 12th invested in companies in Europe and the U.S. — exceeded its target of $300 million. The firm has more than $1.2 billion under management.

The fund invests broadly across all stages of development, including early and late-stage venture deals, clinical co-development, venture investments in public equities (VIPEs) and public equities. Investment size per company will typically range from $15 million to $30 million.

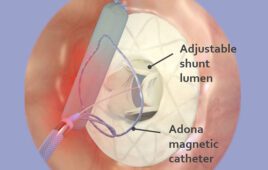

Its medtech portfolio ranges from California permanent-contraception maker Adiana to Stanmore Implants, a UK orthopedics company.