BOCA RATON, Fla., June 8, 2011 /PRNewswire/ — On June 7, 2011,

Vycor Medical, Inc. (“Vycor” or the “Company”) completed the

sale of $1,570,000 in Units comprising Preferred Shares and

Warrants (the “Units”) to accredited investors (the “Investors”).

The Units were issued pursuant to the terms of separate

Series C Convertible Preferred Stock Purchase Agreements between

the Company and each of the Investors. This sale is an initial

closing (the “Initial Closing”) under the Agreements which allow

for maximum proceeds of $3,000,000.

Each Unit was priced at $50,000 and comprised one share of

Series C Preferred Convertible Stock convertible (at the Holder’s

option or mandatorily upon the occurrence of certain events) into

2,222,222 shares of the Company’s Common Stock ($0.0225 per share)

and a Warrant to purchase 1,111,111 shares of the Company’s Common

Stock at $0.03 per share for a period of three years. A total

of 69,777,773 shares of Series C Convertible Preferred Stock and

Warrants to purchase 34,888,890 shares of the Company’s Common

Stock were issued in the offering. The proceeds of the sale

of the Units will be used for working capital and general corporate

purposes. A portion of the proceeds is earmarked for the cost

of investor relations.

14.40 Units were sold in the offering by a placement agent and

the Company directly sold an additional 17.00 Units to

Investors.

About Vycor Medical, Inc.

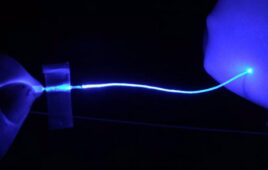

With corporate headquarters in Boca Raton, FL, Vycor Medical,

Inc. (VYCO.BB) is a medical device company committed to making

neurological brain, spinal and other surgical procedures safer and

more effective. The company’s flagship, Patent Pending

ViewSite™ Surgical Access Systems represent an exciting new

minimally invasive access and retraction system that holds the

potential for speedier, safer and more economical brain, spinal and

other surgeries and a quicker patient discharge.

‘/>”/>