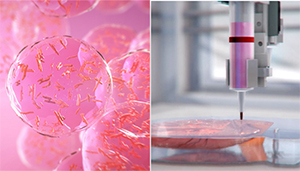

BioLife4D uses a hydrogel and 3D printing process to create a functional heart replacement. Image courtesy of BioLife4d

Regulation A+ (Reg A+) is a funding option that feels tailor-made for high impact technologies like medtech.

Never heard of it? That’s because it didn’t exist until 2015, when the Obama administration passed the JOBS Act. Before then, private companies could only seek backing from the wealthiest 2% of Americans — accredited investors. The new Reg A+ (think “reggae”) rules in Title IV enable small firms to raise money from all Americans in a sort of “mini-IPO.”

The potential for such a system is huge, particularly in medtech. But there are still some risks and pitfalls that interested companies should understand.

One company that’s navigating this funding path is startup BioLife4D, which is developing 3D-bio-printed human hearts for transplantation. BioLife4D’s Reg A+ offering makes up to 5 million shares available for sale to the public. Co-founder, president & CEO Steven Morris told Medical Design & Outsourcing that the Reg A+ process taught him many lessons.

“BioLife4D is not a traditional model for a company and, although there is huge potential for reward, the technology requires investors to accept a lot of risk,” Morris told us.

Printing a heart in three dimensions

BioLife4D’s technology brings together stem-cell science and 3D bioprinting with the aim of building a functional heart that could take the place of transfers. White blood cells harvested from a heart transplant patient are reprogramed into induced pluripotent stem cells. The stem cells are in turn programmed into the various cardiovascular cell types and loaded into a hydrogel that, along with nutrients and growth factors, serves as the bioprinter ink. Layers of the ink are deposited on scaffolds built from the patient’s MRI; after printing, the heart is matured in a bioreactor and conditioned to make it stronger and readied for patient transplant.

The goal is a functional, implantable human heart that minimizes the risk of rejection inherent in donated organs and the attendant need for immunosuppressant therapy. Although the technology for each step is attainable, Morris explained, the biggest problem in re-creating the heart is scaling them to the enormous complexity of the organ. Somewhere in the tens of billions of cells would be required, he estimated, noting that his team is still trying to find solutions for functional vascularization.

In the meantime Morris plans to develop a mini-heart that could be used to test toxicity for pharmaceuticals.

“This would provide a better indicator of human acceptance of a drug than animal testing, with the added benefit that we wouldn’t have to sacrifice thousands of animals every year for safety testing,” he told us.

BioLife4D is also developing printable replacement cardiac valves, Morris added.

“We’re still a few years away from a full heart, but these projects will help our investors see return more quickly,” he said.

The potential of Reg A+…

With RegA+, Morris saw the opportunity to engage a new kind of highly motivated investor.

“Because of the nature of our technology, we realized we couldn’t rely on a traditional investor model. For one, there is no cash flow. Second, there is a huge financial upside, but there is also a high risk,” he explained.

Morris believed he could count on two types of investors: Those who are motivated to further the technology but may not have as much to invest; and “impact” investors looking to make both a social and financial investment.

“It is a good concept if it is done right,” Morris said.

… and its pitfalls

Because the process is so new, there’s a risk that companies will make poor decisions in implementing their offering, leaving them open to predation by the coterie of consultants and law firms needed to effect the flotation.

Entrepreneurs who don’t learn enough about the process can become prey, Morris explained, because there are no standards for how much these groups charge. Quotes from law firms for helping prepare and file the 1A document with the U.S. Securities & Exchange Commission ranging from $25,000 to $175,000, he said.

“I guarantee there is not $150,000 worth of difference in service a firm can provide, nor in the complexity of a potential product,” Morris said.

The cost of the funding portal connecting the company to investors can also vary widely; Morris said his search turned up a portal that charged nearly $200 per investor, which to his mind defeats the purpose of Reg A+.

“These are companies trying to raise money and investors trying to get their money to the right people,” he said. “As of now, it is an inefficient outlet that is hard to regulate.”

Tips for Reg A+ offerings

Morris offered advice for companies looking to gauge the value of Reg A+ for their technology:

- Make sure you have the right “why” for the funding model. Financing with equity means you’ll need to have great marketing and a compelling technology that appeals to a lot of people.

- Don’t call just one consultant, law firm or portal. Talk to a lot of people and be sure to compare and ask hard questions about costs and terms.

- Look for partners with experience in Reg A+, but also with technologies similar to yours. Then double-check with the SEC that they’ve actually done the work they say they’ve done.

- Be realistic with your expectations. Even though Reg A+ delivered big wins for some companies, the reality is that many more were only modest raises – or downright failures.

- Don’t just rely on local talent. Look nationwide for the right experts to meet your needs and budget.

- Know going in that even if you do everything right, you still might not be successful.

Although there are risks, Morris said he believes that Reg A+ has significant fundraising potential, particularly in the medical technology space.

![A photo of the Medtronic GI Genius ColonPro polyp detection system flagging a potential sign of colon cancer during a colonoscopy. [Photo courtesy of Medtronic]](https://www.medicaldesignandoutsourcing.com/wp-content/uploads/2024/04/Medtronic-GI-Genius-doctors-268x170.jpg)