Dave Hudson | President and CEO | Joining Technologies

The healthcare industry is being transformed by the accelerated introduction of smaller and more effective medical devices developed over the past generation. An important factor in this ongoing medical device revolution has been the availability of better and less costly lasers. Advances in laser technology have, in turn, led to the development of better and less costly medical devices.

Improved lasers

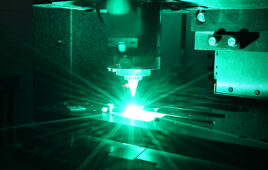

Lasers have evolved significantly over the past 15 years. One reason is due to improvements in the laser resonator. The laser beam originates in the resonator and the lasing medium there determines an operating wavelength.

A common wavelength for industrial laser processing is one micron. Until about 10 years ago, one-micron industrial lasers were incredibly inefficient, with just 3% of the energy from the wall plug ever making its way into the laser beam. The rest was wasted as heat. Over the past decade, however, power efficiency, not to mention reliability and power scaling, has increased with the introduction of two competing resonator designs known as disk and fiber. These designs represent major breakthroughs in laser technology, and they compete with each other, which drives laser costs down. This progression ultimately benefits medical device original equipment manufacturers (OEMs) by providing them access to lower-cost laser processing (in our case, welding) systems and services. The savings are then passed on to healthcare providers who obtain equipment and components from the OEMs at more affordable prices.

In 2006, Joining Technologies bought and installed the first 2-kilowatt disk laser for manufacturing in North America. Within 18 months, an upgraded laser was selling for 30% less, confirming the harsh realization that the disruptive technology the company adopted early had become available to the masses at a lower price. These developments were also a reminder that laser technologies are evolving and advancing at a rapid rate.

The disk and fiber lasers have had a major impact on medical device development. These new lasers are replacing outmoded lamp-pumped lasers at an extraordinary rate because the new designs are smaller, more powerful and efficient, and easier to use. They are also less expensive to purchase than their predecessors. What’s more, new and improved optics coupled with modern power supplies deliver higher power onto smaller focal points, producing deeper penetration welds at faster speeds. Laser beam scanning simplifies part fixturing and boosts weld speeds with previously unheard of positional accuracy.

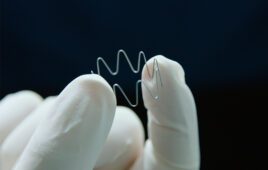

Consider the impact of these advances on the manufacture of high-volume, single-use medical devices. Small, delicate materials are stamped, cut, machined and joined (welded) to create new and improved devices, some of which are near-microscopic in size. The new lasers are pulling cost out of supply chains while at the same time enabling the development of products that would otherwise be impossible to manufacture. And because the technology is affordable and accessible, more companies are offering laser processing as a service. Medical device OEMs are seeing an expanding pool of laser service providers competing for a place in their supply chains.

Cheaper and enhanced

When it comes to laser technology and services, costs have significantly decreased. Current lasers are less expensive to purchase and easier to operate, which has led to an explosion in the number of laser OEMs and service subcontractors peddling their equipment and services to medical device OEMs. The inevitable result of this new competition has been historically low manufacturing costs.

Interestingly, one byproduct of this trend has been a growing chasm in the world of laser-welding specialists. Well established laser-service providers with large engineering staffs have shifted their focus to the advanced technical space, providing high-value engineering services to medical device OEMs and assisting in product design, prototype development and early production. Conversely, newcomers, or companies with smaller engineering budgets, find themselves competing for higher-volume production work during the most mature phases of a product’s lifecycle.