[Image courtesy of Pictures of Money on Flickr, per Creative Commons 2.0 license]

Endra announced May 9 that the IPO would involve 1.68 million units – each including one share of common stock and a warrant to purchase an additional share of common stock – priced at $5 per unit, for a total $8.4 million. Minus the $672,000 underwriting discount and $750,000 in expenses payable by the company, and Endra will have about $7 million to work with.

The units were expected to start trading May 9 on the Nasdaq under the symbol NDRAU, with the offering closing on or about tomorrow. National Holdings subsidiary National Securities Corp. is the sole book-running manager, and Dougherty & Co. is the qualified independent underwriter for the IPO.

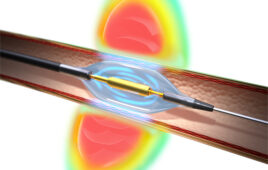

Endra (Ann Arbor, Mich.) has research institutions around the world using its Nexus 128 system, which is a fully 3D photoacoustic system for imaging anatomy, physiology and labeled molecular targets. But Endra’s focus is presently on developing its next-generation technology platform – Thermo Acoustic Enhanced Ultrasound (TAEUS) – that the company thinks could help diagnose of a number of medical conditions that presently require more expensive CT or MRI imaging. TAEUS could also be useful when existing imaging technology is not practical.

Thermo-acoustic technology from Endra could enable health practitioners to use their existing ultrasound equipment for point-of-care visualization of tissue function and composition. Company officials think they have a strong argument for the technology when it comes to such value-based selling points as improving patient access, clinical effectiveness, safety and cost.

Endra plans to use money from the IPO to fund development and regulatory approval, and prepare for the commercialization of the company’s non-alcoholic fatty liver disease TAEUS in Europe, according to the IPO prospectus filed with the U.S. Securities and Exchange Commission. The company, though, warns in the filing that it will need additional funds to commercialize the application in the E.U. and implement the next steps in its business plan.

Risk factors listed in the prospectus include a history of operating losses, with an accumulated deficit of $12.5 million as of the end of 2016. The company also hasn’t completed the development of any applications based on TAEUS, additional clinical data will be needed to prove efficacy to clinicians even after regulatory approval, and the company will need to secure reimbursement from government programs and other third-party payers.

[Want to stay more on top of MDO content? Subscribe to our weekly e-newsletter.]