Deepak Prakash, global director of marketing, Vancive Medical Technologies

Medical device manufacturing is a vibrant industry with applications running the gamut from wound care solutions to new wearable technologies. Original equipment manufacturers (OEMs) are always looking for converters who bring strong capabilities to the table. This includes an understanding of the latest medical materials and expertise in specialized printing, slitting and many other finishing methods.

For converters new to the medical device sector or looking to expand their footprint in the industry, this article will provide a brief market overview and cover some basic materials selection and manufacturing considerations.

Medical device market statistics and growth projections

The medical device sector has a strong track record of innovation and sales growth. IBISWorld estimates that in the U.S. alone, the medical device market consists of over 860 manufacturers, accounting for $45 billion in revenue, with an average annual revenue growth rate of 5.8% from 2011 to 2016.

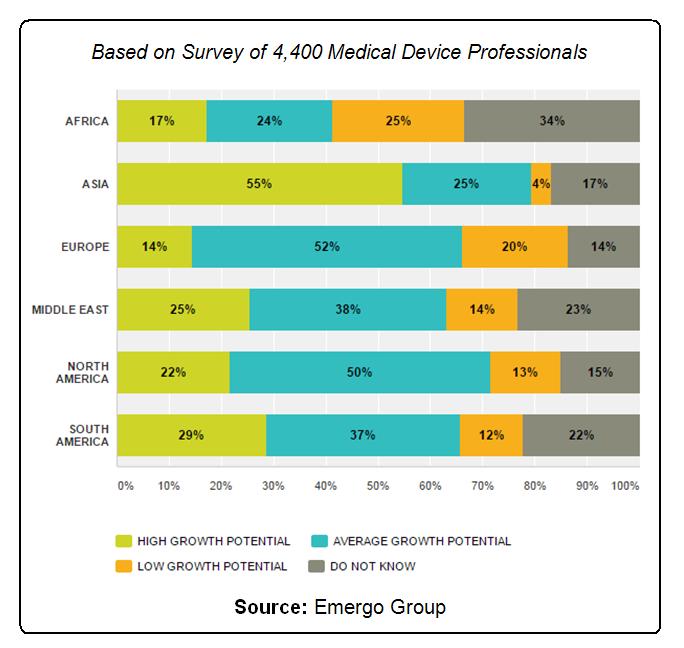

From its recent survey of 4,400 global medical device professionals, consulting firm Emergo Group found that there is great optimism for the sector’s future. Eighty-two percent of respondents said they have a positive outlook for the industry. Emergo’s research also showed that average to high growth potential is expected in medical devices in most global markets over the next five years.

Medical device sales growth potential by region

Medical device industry five-year growth is expected to be average or high in most global markets according to 2016 survey results from Emergo Group.

Based on Survey of 4,400 Medical Device Professionals. Source: Emergo Group

Wearable healthcare applications are an area with particularly high-growth potential. Medical device OEMs are busy with wearable product development and looking for skilled converters who can offer creative solutions and specialized capabilities.

IDTechEx, a market research firm, has predicted the overall wearables sector will grow from $20 billion in 2015 to almost $70 billion in 2025, with healthcare and wellness applications leading the way. In a 2014 study that focused specifically on medical wearables, Soreon Research estimated the wearable medical device market would reach $41 billion by 2020, with 65% CAGR.

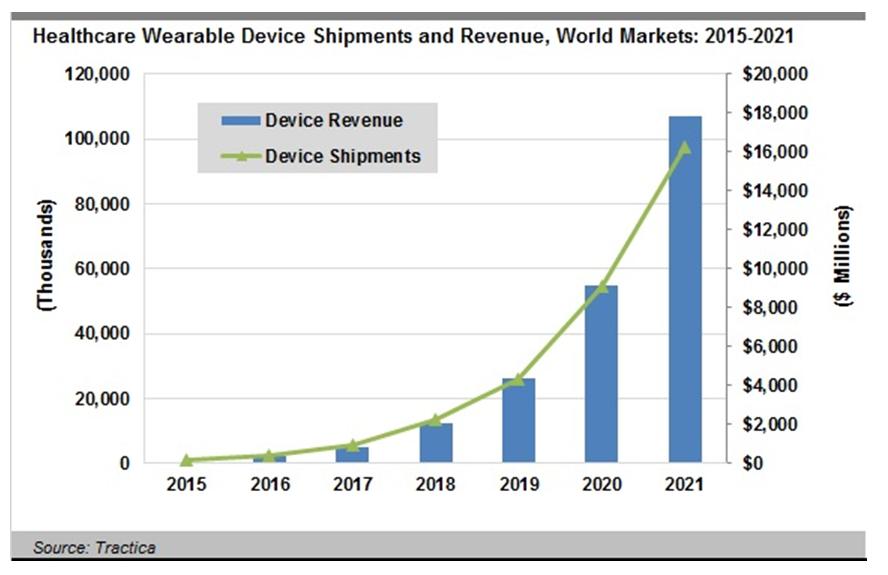

In a report released in Q2 2016, the market intelligence firm Tractica predicted global shipments of healthcare wearables will increase from 2.5 million units in 2016 to 97.6 million units annually by 2021, accounting for $17.8 billion in yearly revenue. “The types of wearables being utilized include well-known devices such as fitness trackers and smart watches, but also emerging categories such as connected wearable patches, pain management devices, wrist devices, and posture monitors, among many others,” Tractica reported.

Skin-contact wearables, such as body-worn patches, can be an attractive option for medical device OEMs who are concerned with capturing highly accurate cardiac and muscle signals. They also have the advantage of being discreet for patients, who can wear the patches under clothing while they undergo physiologic monitoring. In a Q2 2015 report, Tractica estimated there will be 12.3 million shipments of clinical and non-clinical connected wearable patches, representing revenues of $3.3 billion annually by 2020. This is up sharply from 67,000 wearable patch units shipped in 2014, according to the firm.

The world market for healthcare wearable devices is expected to reach $17.8 billion by 2021, according to market intelligence firm Tractica.

Tips for getting started in medical converting

Today’s medical device OEMs often are looking for the one-stop shop. They would rather not be responsible for moving materials and work-in-process repeatedly from one facility to another. Device developers will be attracted to converters who can procure their own materials, develop prototypes rapidly and perform complex finishing techniques.

Equipment considerations: Medical device OEMs may turn to converters who have specialized equipment for embossing, kiss cutting, heat sealing, placing islands, laminating, slitting/rewinding, die cutting, laser cutting, perforating and packaging. In addition, sterilization and clean room capabilities are critical for many medical device applications.

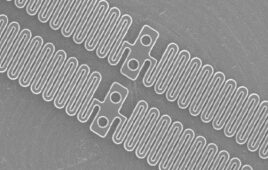

Printing capabilities also are important, especially for wearables. Additionally, many OEMs are looking for converters who are able to add conductive circuitry to roll goods. As Converting Quarterly reported in its Q1 2016 edition, “Efforts to miniaturize all of the components used in wearable products … are underway. Use of printed electronics on flexible substrates is one of the major technologies being explored to do this.”

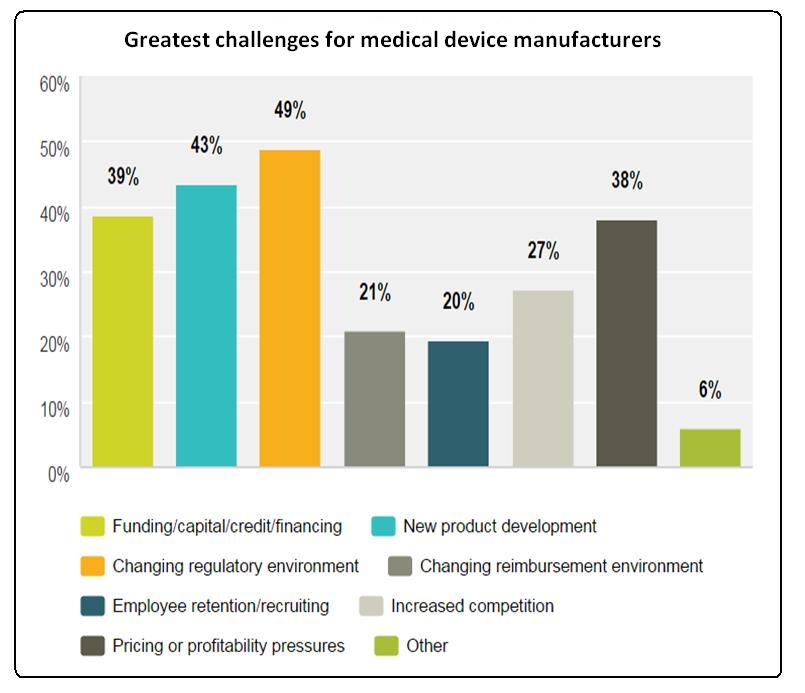

Manufacturing practices and regulatory compliance: Familiarity and compliance with medical device regulations is essential for converters who want to enter or expand their work with device developers. In its industry survey, Emergo found that the changing regulatory environment was the biggest challenge faced by 49% of survey respondents. Converters who can help OEMs navigate these shifting waters will be strong partners.

The greatest challenges facing the medical device industry are the changing regulatory environment and new product development, according to a 2016 survey by Emergo.

If converters are new to medical device work, they most likely will need to register their facilities with the U.S. Food and Drug Administration (FDA) and to implement Current Good Manufacturing Practices (CGMP) if they are not already in place. International Standards Organization (ISO) and other quality certifications also are a major asset for businesses keen on medical converting.

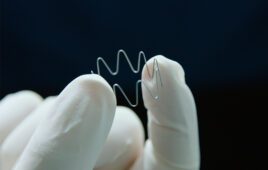

Converters with expertise in wearables, including body-worn patches such as the one shown here, can work with device OEMS to tap into this growing market. Photo courtesy of Vancive Medical Technologies.

Manufacturing and regulatory expertise should be a shared focus between device OEMs, converters and their suppliers. OEMs bear the greatest burden for compliance throughout their products’ lifecycles, and they value converters and suppliers who are vigilant and meticulous in their own regulatory documentation and protocols. “Under the QS [quality system] regulations, manufacturers are expected to control their devices from the design stage through post-market surveillance,” according to the FDA’s Compliance Program Guidance Manual. “Manufacturing processes, such as sterilization, are required to be implemented under appropriate controls.”

Materials selection: Medical device OEMs may turn to converters for both creative ideas and practical solutions for new product concepts they want to bring to market. Materials selection plays a major role in this new product development, and OEMs are eager for partners who offer materials science expertise.

Behind the changing regulatory environment, the second-most cited hurdle among device makers was new product development, according to Emergo’s survey results. Forty-three percent of respondents said new product development was their greatest challenge (see Figure 3). Converters have an opportunity to assist device OEMs with this product development. Medical materials expertise and ready access to a variety of fabrications is a competitive advantage in this regard.

In medical device converting, quick prototyping is important. This requires fast access to materials with many different thicknesses, sizes, configurations and adhesive chemistries. Photo courtesy of Vancive Medical Technologies.

For example, a device OEM may turn to a converter to seek advice on what materials will adhere best to a certain substrate or which roll good is well suited for high-speed processing. Or the device developer may need a very quick turnaround on a prototype concept. Converters will want to develop relationships with medical materials vendors who offer wide product portfolios, including materials with many different thicknesses, sizes, configurations and adhesive chemistries.

Converters may wish to ask their suppliers about online apps to help speed up the material selection process. Some materials suppliers also will provide medical converters with on-site fabric libraries so that the converters can quickly make samples for OEM customers. It is not unusual for an OEM to need a prototype within days or a few weeks at most. In such cases, the converter cannot afford to wait six weeks for material delivery.

Device developers also may turn to converting partners to help them in selecting the right material for new wearable applications. Because of the intimacy between these devices and the patient’s body, sometimes for prolonged periods of up to a week, these wearables need to be constructed of skin-friendly adhesives and materials with extended-wear functionality.

The medical device industry is growing steadily, and there is rapid expansion in the emerging wearables category. Device OEMs need converting partners who are responsive, offering quick-turn prototypes. They also seek partners who comply with FDA and other regulatory requirements. Converters can collaborate with medical materials suppliers to meet these needs.

For further reading

- Emergo Group. (2016). Global Medical Device Industry Outlook for 2016. Emergo Group. Retrieved April 18, 2016, from http://www.emergogroup.com/resources/research/outlook-medical-device-industry

- Harrop, D. P., Hayward, J., Das, R., & Holland, G. (2015). Wearable Technology 2015-2025: Technologies, Markets, Forecasts. London: IDTechEx Inc. Retrieved from http://www.idtechex.com/research/reports/wearable-technology-2015-2025-technologies-markets-forecasts-000427.asp

- (2016, January). Medical Device Manufacturing in the US: Market Research Report. Retrieved April 18, 2016, from http://www.ibisworld.com/industry/default.aspx?indid=764

- , J. B. (2016). Printed Electronics USA 2015: A technology review. Converting Quarterly, 6(1), 52-54. Retrieved April 18, 2016, from http://www.mydigitalpublication.com/publication/?m=16737&l=1#{“issue_id”:289447,”page”:54}

- Soreon Research. (2014). The Wearable Health Revolution: How Smart Wearables Disrupt the Healthcare Sector. Zurich: Soreon Research. Retrieved from http://www.soreonresearch.com/wearable-healthcare-report-2014/

- (2016, April 14). Healthcare Wearable Device Shipment to Reach 98 Million Units Annually by 2021. Retrieved April 18, 2016, from https://www.tractica.com/newsroom/press-releases/healthcare-wearable-device-shipments-to-reach-98-million-units-annually-by-2021/

- (2015, May 18). Connected Wearable Patch Shipments Will Reach 12.3 Million Units Annually by 2020. Retrieved from https://www.tractica.com/newsroom/press-releases/connected-wearable-patch-shipments-will-reach-12-3-million-units-annually-by-2020/

- S. Food and Drug Administration. (n.d.). Compliance Program Guidance Manual. Retrieved April 18, 2016, from http://www.fda.gov/downloads/MedicalDevices/DeviceRegulationandGuidance/GuidanceDocuments/UCM244277.pdf

Deepak Prakash is global director of marketing at Vancive Medical Technologies, an Avery Dennison business. He has 20 years of healthcare experience spanning marketing and product development. He holds a master’s degree in chemical engineering from the University of Akron and a master’s degree in business administration from Northwestern’s Kellogg School of Management. Reach Prakash at 312-629-4604, or deepak.prakash@averydennison.com, vancive.averydennison.com.