Earlier this week, word came out that Stryker intended to purchase the Canada-based Novadaq Technologies, Inc. The deal would immediately make Stryker a major player in the realm of surgical imaging, part of the healthcare space not robustly served by any of the company’s core divisions.

The stock acquisition deal establishes a total value for Novadaq topping $700 million.

Jason Mills, an analyst with Canadian financial services company Cannacord Genuity, notes that the sale of Novadaq wasn’t entirely unexpected, given recent struggles.

“We see this deal as a logical exit for the company, which we have criticized lately for poor management execution and equivocal capital sales strategy,” says Mills.

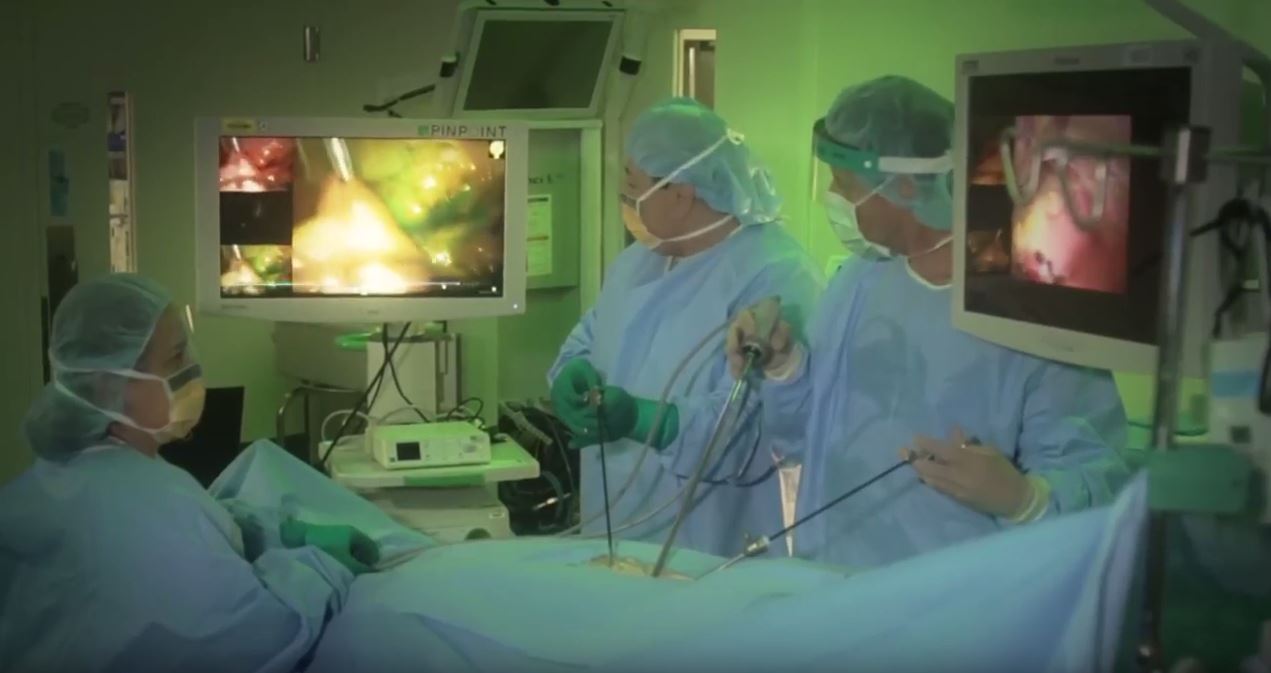

(Image credit: screengrab from Novadaq video/YouTube)

Mills points out that Novadaq had a rough fourth quarter in 2016, the result of fundamental problems with their selling strategies. The acquisition by Stryker puts Novadaq technology in the hands of a corporation with extensive reach in the healthcare industry.

While Stryker is already celebrating the expansion of their product offerings the Novadaq pick-up represents, Mills cautions the deal could still be upended by competitive bids. He names Medtronic, Johnson & Johnson, and Intuitive Surgical Inc. as companies that could make a play for Novadaq, possibly prompting a bidding war.

“While competitive bids are usually low probability in med-tech, we think the potential is a bit higher in this case,” Mills says.

Assuming the deal goes through, it’s forecasted to close before the end of the year.